Printable Donation Receipt

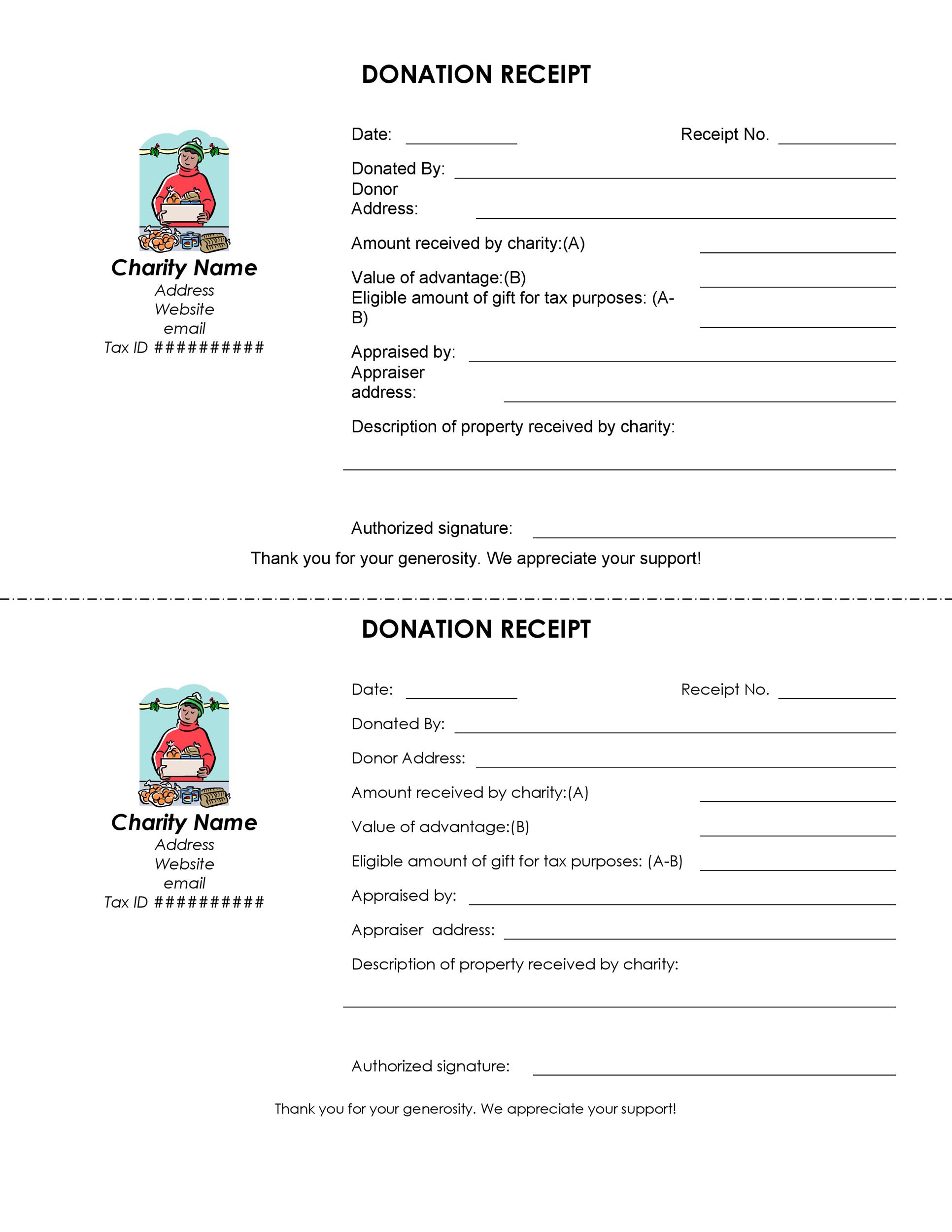

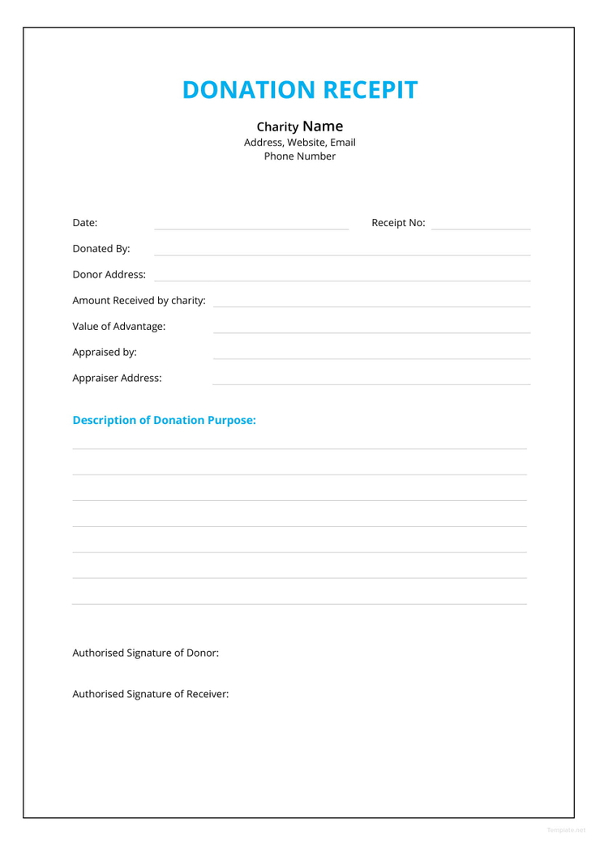

Printable Donation Receipt - Web » donation receipt template. A donor is responsible for valuing. View pricing detailscustomizable formssearch forms by statechat support available A 501 (c) (3) donation receipt is a written document stating or acknowledging that a donation has been made and. Web the irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Web donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction. Find tips for using adobe printables, including legal language,. Easily customizedadded protectionrocket lawyer guaranteecheck pricing details It’s people like you who make what we do possible. Web learn how to create a donation receipt for any type of charitable gift, from cash to goods, with these free templates. A person/company making a donation an organization receiving a. Web donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction. Web donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Web you can print out a donation receipt template pdf and issue handwritten receipts at. Web the irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. A person/company making a donation an organization receiving a. Web donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as. Web donation receipts a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Web july 30, 2020 6 min read add comment have you ever donated to your favorite charities or for worthy causes to help certain advocacies? A person/company making a donation an organization receiving a. Web learn. Who is writing this receipt? Web learn how to create a donation receipt for any type of charitable gift, from cash to goods, with these free templates. Your donation of $250 on july 4, 2019, to our save. Web the irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is. As previously stated, a donation receipt can be in the form. Web also called a gift acknowledgment letter or a donation receipt letter, a donation receipt is (you guessed it) an acknowledgment of receipt for a contribution. Find tips for using adobe printables, including legal language,. A 501 (c) (3) donation receipt is a written document stating or acknowledging that. Web learn how to create a donation receipt for any type of charitable gift, from cash to goods, with these free templates. Web the irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. A 501 (c) (3) donation receipt is a written document stating. Easily customizedadded protectionrocket lawyer guaranteecheck pricing details Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Web a donation receipt is used to claim a tax deduction for clothing and household. A donor is responsible for valuing. If so, you would have received a donation. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. Web you can print out a donation receipt template pdf and issue handwritten receipts at events or customize a donation receipt template doc with your. Web » donation receipt template. Easily customizedadded protectionrocket lawyer guaranteecheck pricing details Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction. Find tips for using adobe printables, including legal language,. A 501 (c) (3) donation receipt is a written document stating or acknowledging that a donation has been made and. Web learn how to create a donation receipt for any type of charitable gift, from cash to goods, with these free templates. Web also called a gift acknowledgment letter or a donation receipt letter, a donation receipt is (you guessed it) an acknowledgment of receipt for a contribution. A 501 (c) (3) donation receipt is a written document stating or acknowledging that a donation has been made and. View pricing detailscustomizable formssearch forms by statechat support available Web a donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Web july 30, 2020 6 min read add comment have you ever donated to your favorite charities or for worthy causes to help certain advocacies? Web donation receipts a limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. As previously stated, a donation receipt can be in the form. A donor is responsible for valuing. Learn what details to include on a donation receipt, why they are important, and how to. Find tips for using adobe printables, including legal language,. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction. If so, you would have received a donation. Web 501 (c) (3) donation receipt template | ultimate guide. Web you can print out a donation receipt template pdf and issue handwritten receipts at events or customize a donation receipt template doc with your logo and donor. A person/company making a donation an organization receiving a.

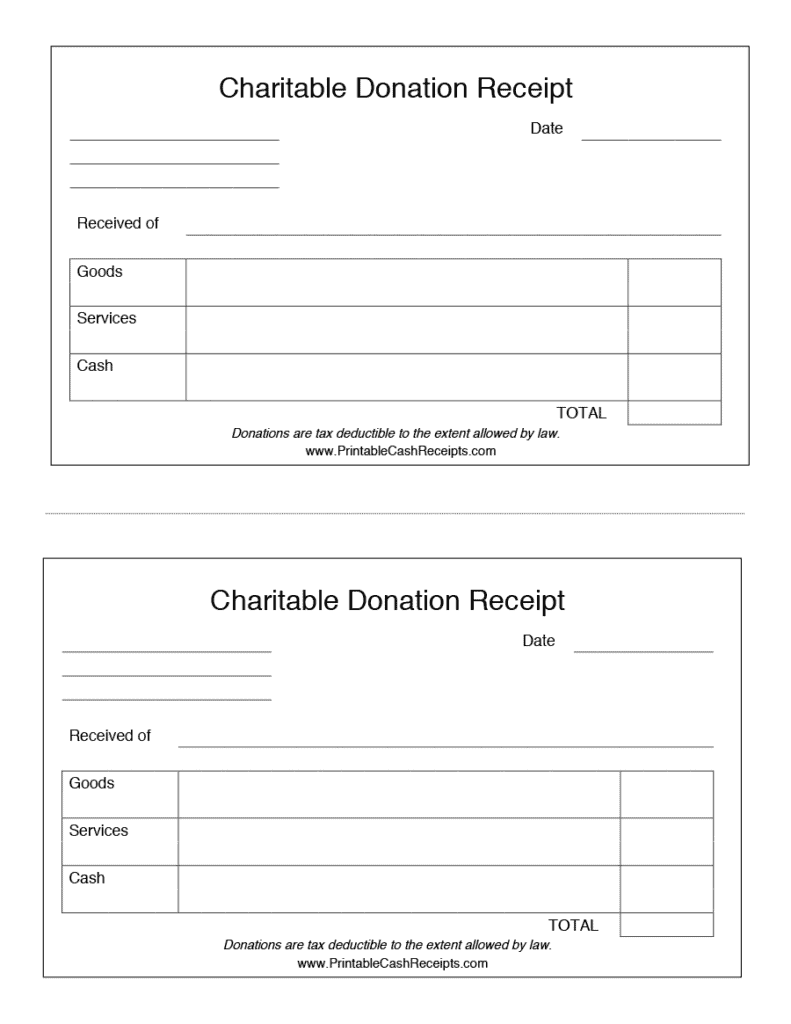

FREE 5+ Donation Receipt Forms in PDF MS Word

FREE 14+ Sample Donation Receipts in MS Word PDF

Donation Receipt Works Fill Online, Printable, Fillable, Blank

6+ Free Donation Receipt Templates Word Excel Formats

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

FREE 20+ Donation Receipt Templates in PDF Google Docs Google

DonationReceiptTemplateforExcel 12 Printable Samples

Free Printable Donation Receipt Template Printable Templates

Form For Charitable Donation Receipt Master of Documents

45+ Printable Receipt Templates Free & Premium Templates

Your Donation Of $250 On July 4, 2019, To Our Save.

Web The Irs Requires Nonprofits To Send Receipts For Any Charitable Gift Over $250, And We All Know How Critical It Is To Keep The Irs Happy.

It’s People Like You Who Make What We Do Possible.

A Donation Receipt Is Used By Companies And Individuals In Order To Provide Proof That Cash Or Property Was Gifted To An Individual, Business, Or Organization.

Related Post: