Can A 1099 Employee Draw Unemployment

Can A 1099 Employee Draw Unemployment - However, the federal government created new provisions that allow 1099 earners to tap into unemployment benefitsduring the ongoing. The factors below are used. Historically, 1099 employees could not collect unemployment; Appreciation week · event calendar · webinars Neither independent contractors, nor their. Web these benefits were recently updated and extended when the continued assistance for unemployed workers act of 2020 (continued assistance act) was signed. Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. Web in short, 1099 independent contractors cannot collect unemployment. These benefits are available to employees because their employers pay state. You do, however, have the. You may be eligible if you are partially (working less hours) or totally unemployed due to no fault of your own. You can elect to have deductions taken out at the time you file your claim or after. You do, however, have the. However, the federal government created new provisions that allow 1099 earners to tap into unemployment benefitsduring the. Assistance is available for periods of unemployment between. Web on top of the ppp program and tax changes, the cares act also opens the door for some 1099 earners to receive unemployment benefits from the pandemic. Everything you need to know. Web these benefits were recently updated and extended when the continued assistance for unemployed workers act of 2020 (continued. Web ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if you're out of work. Neither independent contractors, nor their. You may be an employee under the law, even if: Existing claimants who have maxed out their unemployment benefits. Web in short, 1099 independent contractors cannot collect unemployment. The factors below are used. Web unemployment insurance benefits are subject to state and federal income taxes. You may be an employee under the law, even if: Web workers receiving a form 1099 typically don’t qualify for unemployment benefits. Existing claimants who have maxed out their unemployment benefits. You may be an employee under the law, even if: You may be eligible if you are partially (working less hours) or totally unemployed due to no fault of your own. Web these benefits were recently updated and extended when the continued assistance for unemployed workers act of 2020 (continued assistance act) was signed. Web on top of the ppp. Existing claimants who have maxed out their unemployment benefits. Web unemployment insurance benefits are subject to state and federal income taxes. Appreciation week · event calendar · webinars Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. However, the federal government created new provisions that allow. Web unemployment insurance benefits are subject to state and federal income taxes. You may be eligible if you are partially (working less hours) or totally unemployed due to no fault of your own. Web workers receiving a form 1099 typically don’t qualify for unemployment benefits. These benefits are available to employees because their employers pay state. Appreciation week · event. There are a number of different benefits you can offer your 1099 workers. You do, however, have the. Assistance is available for periods of unemployment between. Web what benefits can you offer 1099 workers? The federal agency you worked for. Web in short, 1099 independent contractors cannot collect unemployment. Appreciation week · event calendar · webinars Web am i eligible for unemployment benefits? Everything you need to know. However, the federal government created new provisions that allow 1099 earners to tap into unemployment benefitsduring the ongoing. Appreciation week · event calendar · webinars In most states, companies pay a tax to cover. Web workers receiving a form 1099 typically don’t qualify for unemployment benefits. You may be eligible if you are partially (working less hours) or totally unemployed due to no fault of your own. You can elect to have deductions taken out at the time. Assistance is available for periods of unemployment between. However, the federal government created new provisions that allow 1099 earners to tap into unemployment benefitsduring the ongoing. Web unemployment insurance benefits are subject to state and federal income taxes. Everything you need to know. There are a number of different benefits you can offer your 1099 workers. Historically, 1099 employees could not collect unemployment; You may be eligible if you are partially (working less hours) or totally unemployed due to no fault of your own. Web workers receiving a form 1099 typically don’t qualify for unemployment benefits. Appreciation week · event calendar · webinars Health insurance, dental and vision. Web ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect unemployment if you're out of work. In most states, companies pay a tax to cover. Web though many companies use the term 1099 employee, it isn’t really accurate because the irs classifies workers who receive 1099s as nonemployees. Web these benefits were recently updated and extended when the continued assistance for unemployed workers act of 2020 (continued assistance act) was signed. A 1099 employee is one that doesn't fall under. Neither independent contractors, nor their.

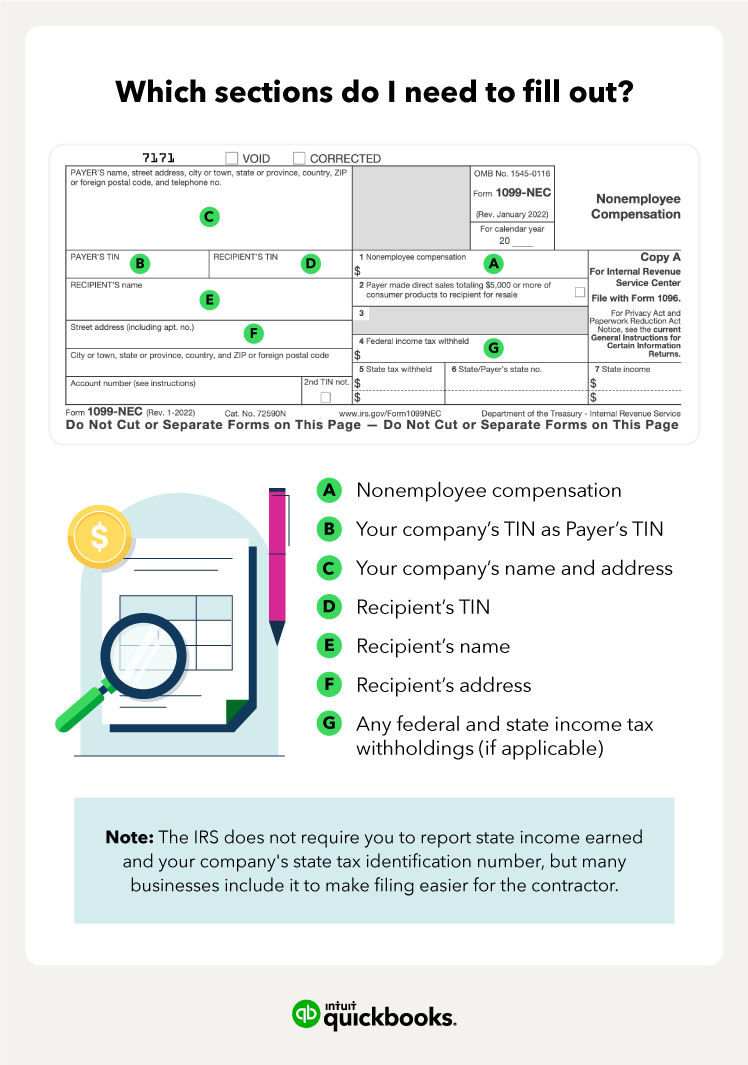

How to fill out a 1099 form QuickBooks

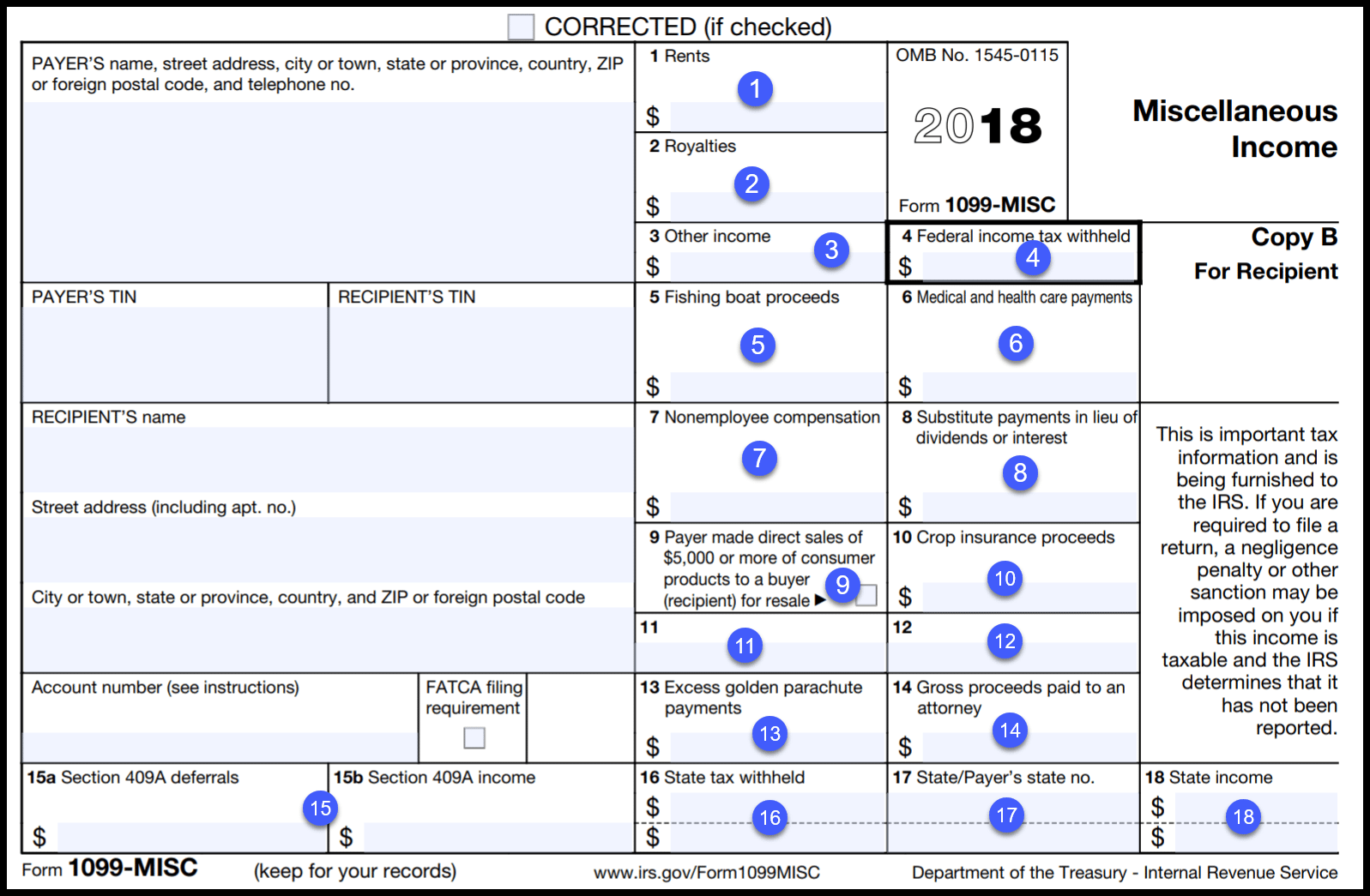

What Is A 1099 Form A Simple Breakdown Of The IRS Tax Form

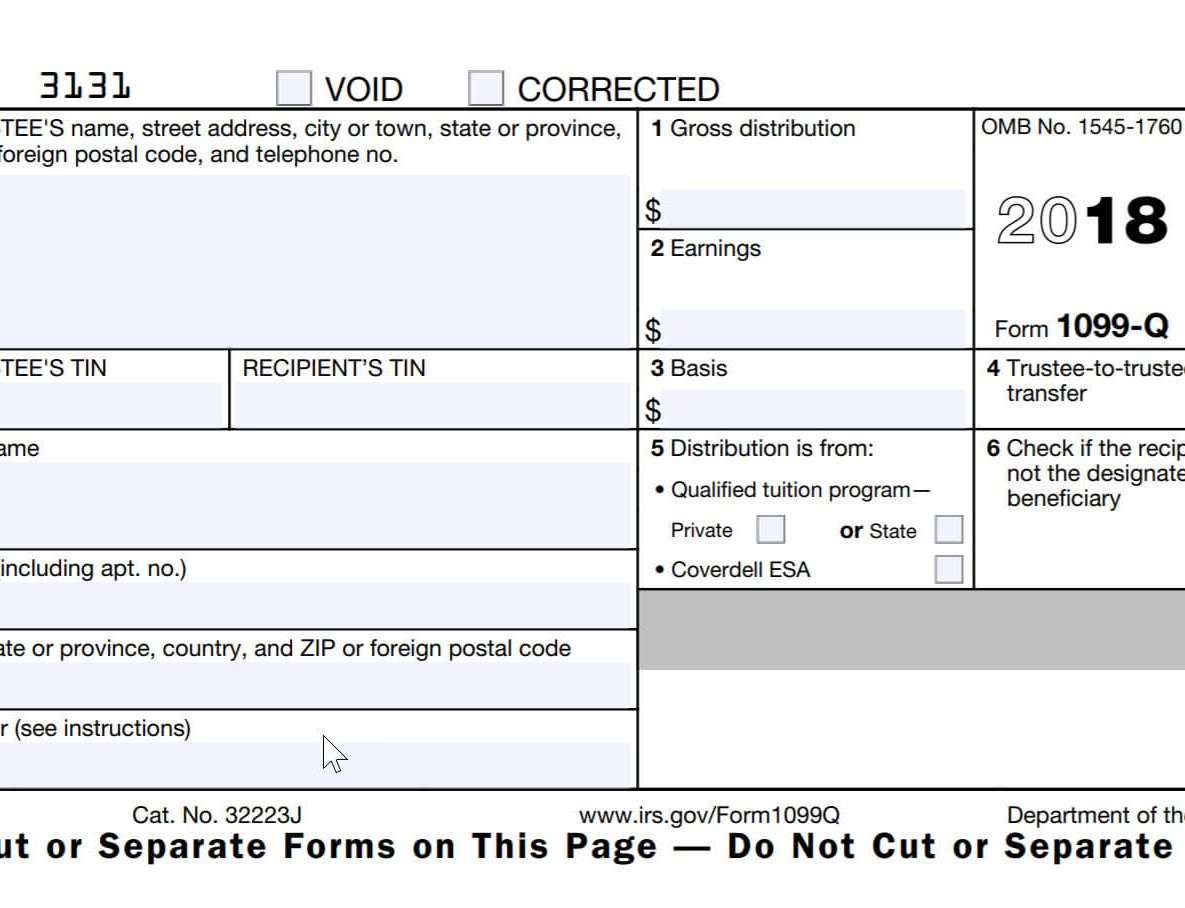

1099 Basics & FAQs ASAP Help Center

Can a 1099 Collect Unemployment? got1099

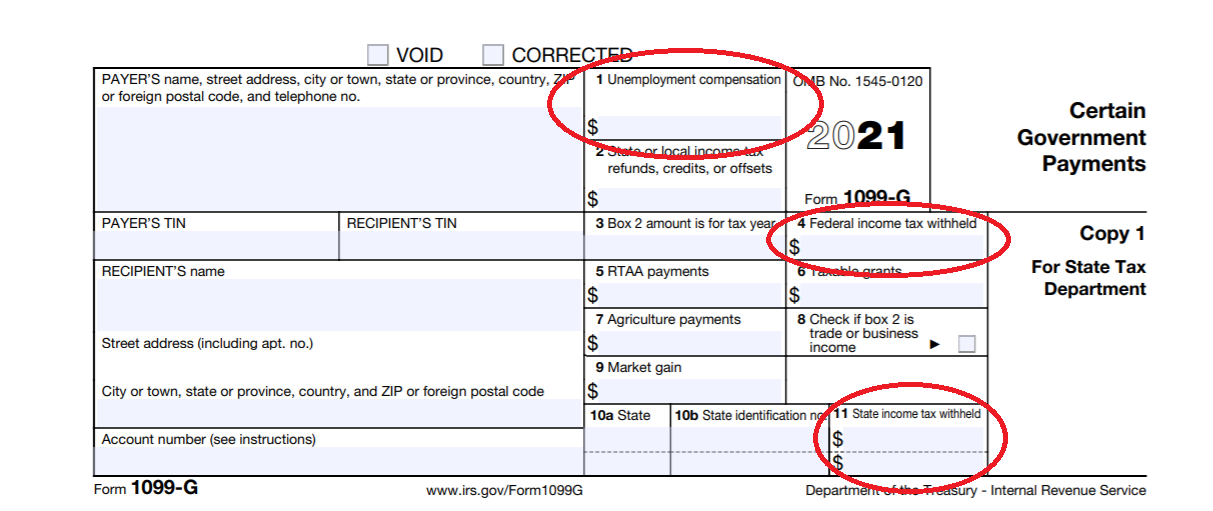

How to Report your Unemployment Benefits on your Federal Tax Return

IRS Form 1099 Reporting for Small Business Owners

1099 Form

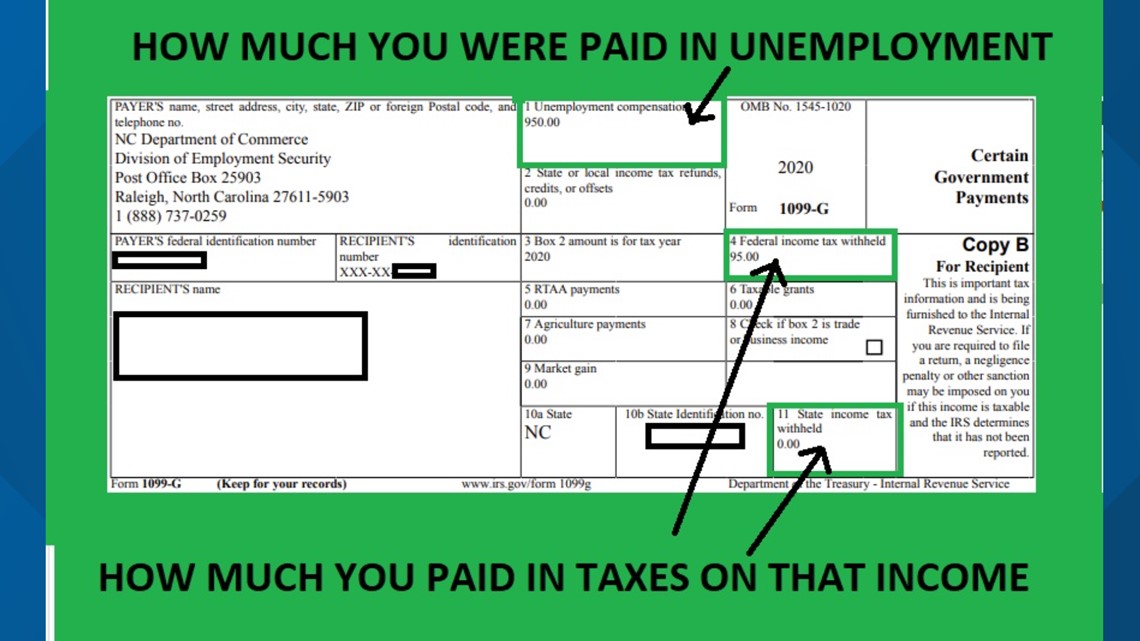

1099G Unemployment Forms Necessary to File Taxes Are Now Available at

Unemployment benefits are taxable, look for a 1099G form

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

The Factors Below Are Used.

Web On Top Of The Ppp Program And Tax Changes, The Cares Act Also Opens The Door For Some 1099 Earners To Receive Unemployment Benefits From The Pandemic.

Startup Law Resources Employment Law, Human Resources.

Web In Short, 1099 Independent Contractors Cannot Collect Unemployment.

Related Post: